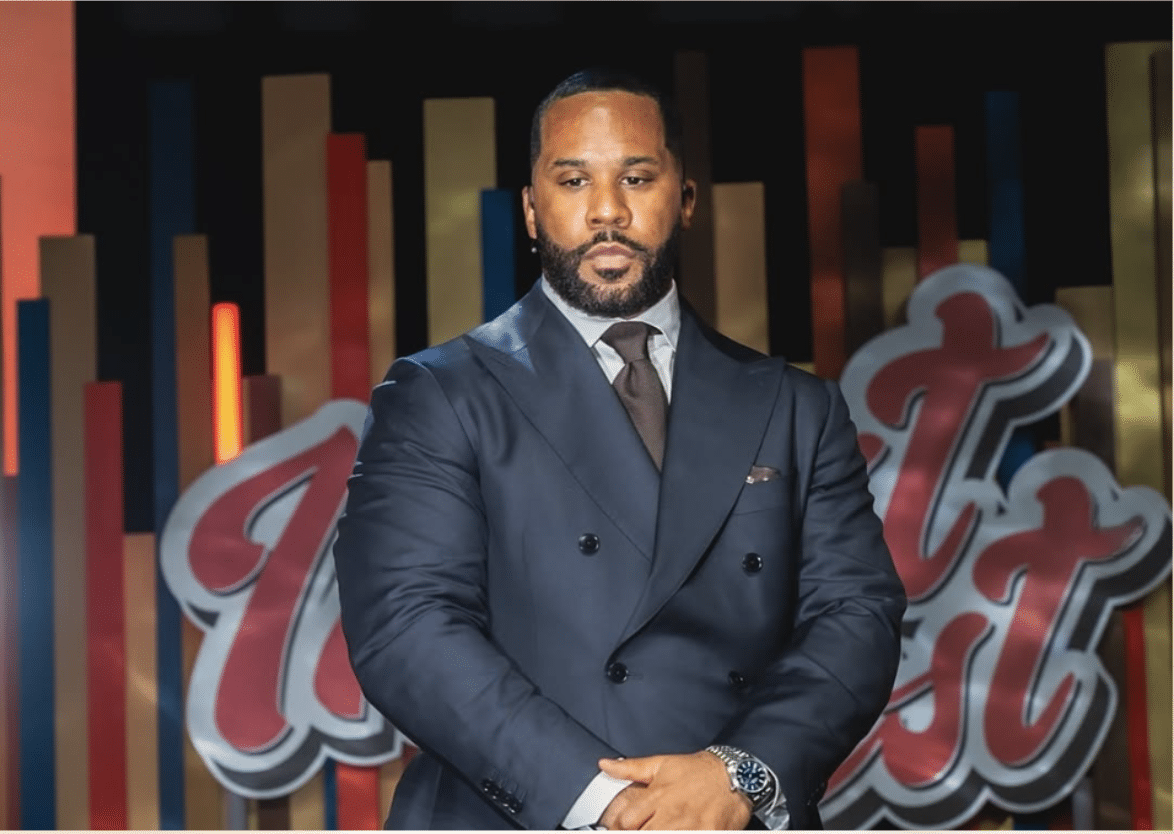

Ian Dunlap, known as the “Master Investor,” has made a significant name in the financial world.

His expertise in investing and wealth building has earned him respect across the industry.

Starting from humble beginnings, Dunlap worked his way to become a leader in smart investments and financial education.

Today, his influence extends beyond personal wealth to making financial knowledge accessible to everyone.

This article examines Ian Dunlap’s current net worth, his changes over time, his investments, assets, and what drives his success.

We’ll also share interesting facts about his life and career to paint a clear picture of who he is and what he stands for in the financial community.

Current Net Worth of Ian Dunlap – $50 Million

As of 2025, Ian Dunlap’s net worth stands at approximately $50 million.

This wealth comes from his investments, business ventures, and educational projects over the years.

Dunlap built his fortune through careful planning and disciplined investing approaches focused on long-term growth.

His financial success places him among the most respected investors in the United States.

He continues to grow his wealth through new opportunities and business ventures.

His financial achievements are documented on his official profiles and in finance news publications.

Dunlap is often featured for his investment strategies and financial advice to both beginners and experienced investors.

Net Worth Evolution Over Time

Dunlap’s wealth didn’t appear overnight but grew steadily through smart investment strategies and expanding business interests.

In his early career, he focused on mastering investment basics and launching his first businesses.

As his experience grew, his investments began yielding returns, steadily increasing his wealth.

Reports estimated his net worth at $50 million by 2023, though recent 2025 figures show it closer to $40 million.

This adjustment reflects market changes and business decisions, but his financial position remains strong.

His growth pattern demonstrates the effectiveness of patience and strategic financial choices in building lasting wealth.

Celebrity’s Diversified Investments

Dunlap’s portfolio travels multiple sectors with estimated values:

- Tech startups: $10-15 million invested in emerging technology companies with high growth potential

- Stock market holdings: $12 million in carefully researched companies with strong fundamentals

- Real estate investments: $8 million in residential and commercial property holdings

- Red Panda Academy: His educational platform is valued at approximately $5 million

This diversification strategy minimizes risk while maximizing long-term growth potential.

Dunlap’s investment approach emphasizes thorough research before committing capital, a practice he teaches to his students and followers.

He avoids trendy investments without solid fundamentals, preferring opportunities with proven business models and clear paths to profitability.

Major Assets

Dunlap’s most valuable assets include his business holdings and strategic investments in high-performing stocks.

His finance consulting firm generates consistent revenue while providing a platform to showcase his expertise.

As co-founder of an online education platform, he’s created both a valuable business asset and a vehicle for sharing financial knowledge.

These assets contribute to his net worth, amplify his influence in financial education, and help establish his credibility as the “Master Investor.”

His business holdings also create multiple streams of income, a principle he strongly advocates in his teaching.

Properties

Dunlap owns a luxury residence in Houston, Texas, that serves as both his primary home and a strategic real estate investment.

His $2 million Florida property functions as a vacation home and long-term appreciation asset.

Both properties were purchased between 2018-2022 during favorable market conditions.

The locations support his business operations while providing tax advantages.

These real estate holdings represent approximately 20% of his total asset portfolio and demonstrate his principle of investing in tangible assets with growth potential.

The properties are in areas with strong appreciation histories, reflecting his strategic approach to real estate investment.

Dunlap’s Overall Career Earnings

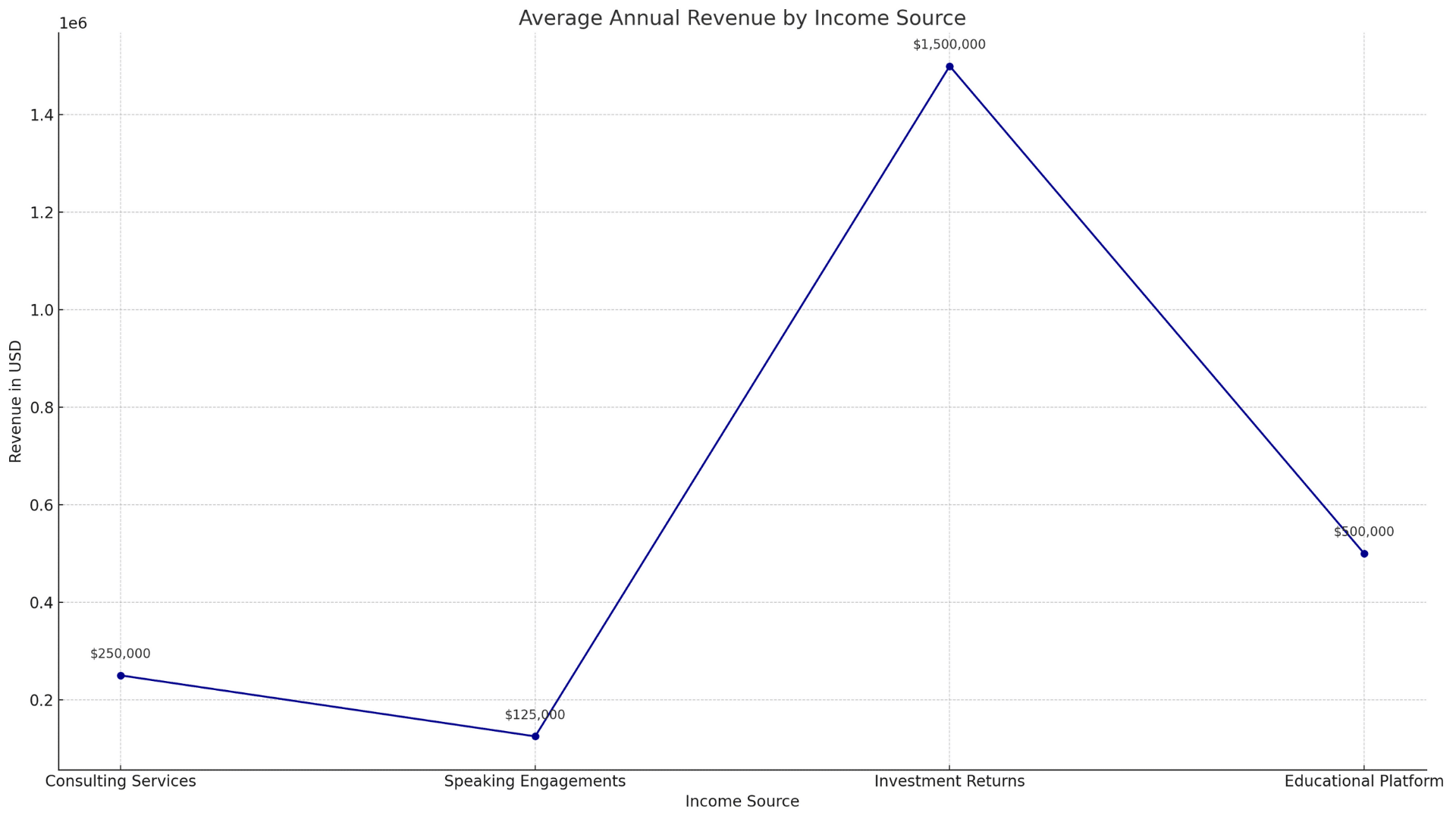

Dunlap’s income breaks down into several streams:

- Consulting services: $200,000-$300,000 yearly from advising clients on investment strategies

- Speaking engagements: $100,000-$150,000 annually from conferences and events

- Investment returns: Variable, averaging $1-2 million yearly from his diverse portfolio

- Educational platform revenue: Approximately $500,000 annually from courses and materials

His diverse income sources create financial stability while allowing him to pursue new opportunities and expand his wealth-building strategies.

This multi-stream approach to income is a key principle he teaches to students seeking financial independence.

Ian Dunlap’s Private Life

Dunlap maintains privacy regarding his personal life while emphasizing the importance of family and community.

Growing up in East Chicago, Indiana, shaped his financial mindset, as early economic challenges motivated his interest in wealth building.

Though married, he keeps his family life separate from his public persona.

His values strongly influence his business decisions, particularly his commitment to financial education.

Dunlap regularly connects his upbringing to his teaching philosophy, believing financial struggles provide valuable perspective for those seeking financial independence.

This background gives him unique insight into the challenges many of his students face.

Fun Fact: Ian Dunlap is a big basketball fan and frequently uses sports analogies to explain complex investment strategies to his students. He believes the discipline and strategy required in sports parallel successful investing.

Early Life

Born on August 2, 1982, in East Chicago, Indiana, Dunlap grew up experiencing financial difficulties.

These early challenges sparked his interest in money management from a young age.

Rather than being discouraged, he became motivated to find ways to earn and save money as a child.

His family’s situation taught him valuable lessons about financial discipline and the importance of planning.

These formative experiences laid the foundation for his later success in the financial world and gave him empathy for others facing similar challenges.

Career Beginnings

Dunlap started with small business ventures while educating himself about finance.

His formal education includes the Harvard Business School’s Owner/President Management Program, which provided essential business leadership skills.

His first significant success came from founding a finance consulting company, followed by co-founding the Red Panda Academy.

These early career moves showed his dual focus on building businesses while helping others understand financial principles.

His approach to career development has always balanced personal success with teaching and mentoring others.

Fun Fact: Dunlap started his career by sharing investment tips on Facebook, building his reputation from the ground up before becoming a recognized financial educator.

Celebrity’s Future Investment Goals

Dunlap plans to expand his investment portfolio in several key areas:

Technology Sector Expansion by 2026

He aims to increase his tech investments by 30%, focusing on artificial intelligence and financial technology startups with high growth potential.

This includes early-stage companies developing innovative solutions for the financial services industry.

Educational Platform Scaling

Plans include growing the Red Panda Academy’s reach by 50% within two years through new online courses and community programs.

He intends to develop new content targeting specific demographic groups underrepresented in investing.

Real Estate Portfolio Diversification

Dunlap intends to add commercial properties worth $3-5 million to his holdings, targeting areas with strong development forecasts.

He’s particularly interested in mixed-use developments in growing metropolitan areas.

These moves align with his long-term value philosophy and expand his financial education mission to diverse audiences.

Philanthropy and Charity Work

Dunlap actively supports educational initiatives through concrete actions:

- Funds scholarships for finance and entrepreneurship students from underserved communities

- Partners with financial literacy organizations to provide free workshops in low-income areas

- Donates approximately 10% of Red Panda Academy profits to educational charities

- Mentors young entrepreneurs through structured programs that provide both guidance and networking opportunities

His charitable work extends beyond monetary contributions to include direct involvement in teaching and mentoring.

Through these efforts, Dunlap demonstrates his commitment to making financial knowledge accessible to all, regardless of background or economic status.

He regularly participates in community events aimed at increasing financial literacy among young people.

Fun Fact: Dunlap’s Red Panda Academy has helped thousands learn investing, with many students going from financial beginners to building six-figure portfolios.

Conclusion

Ian Dunlap’s million-dollar net worth represents more than financial success; it demonstrates the power of knowledge, discipline, and strategic thinking.

From his early Indiana days, Dunlap has consistently shown that careful planning leads to meaningful achievement.

His current status as a respected investor and educator reflects his commitment to helping others.

With new ventures on the horizon and a continued focus on financial education, he is positioned for further growth and influence in the coming years.

His greatest legacy may not be his wealth but the thousands he’s guided toward financial independence through teaching and example.

As markets evolve, Dunlap’s adaptable approach and commitment to financial education ensure his relevance and impact in the financial world.