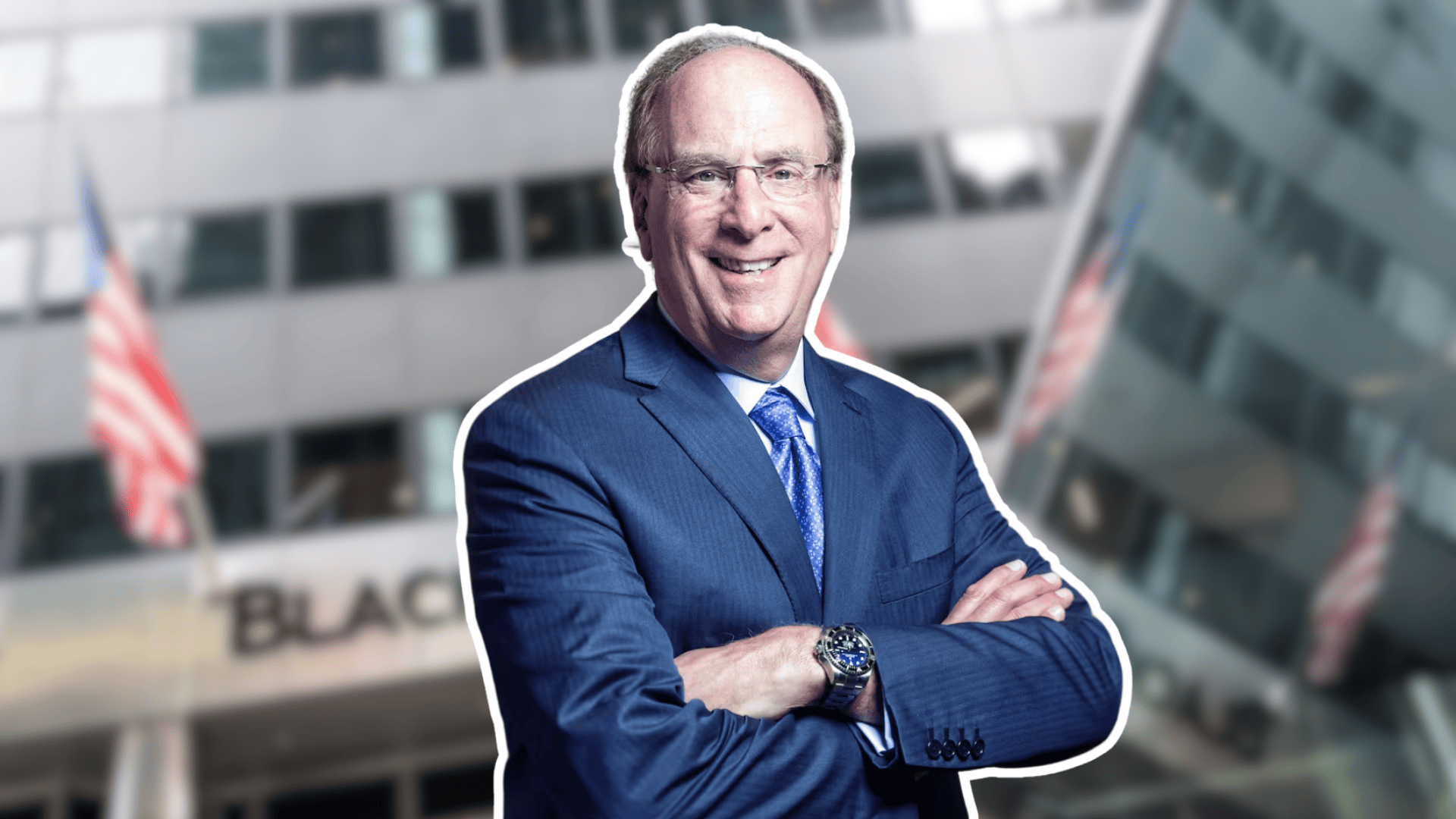

Larry Fink stands as one of the most influential figures in global finance, steering BlackRock to become the world’s largest asset management firm.

Born in California in 1952, Fink’s travel from his early career at First Boston to co-founding BlackRock in 1988 demonstrates remarkable business acumen and strategic vision.

Despite managing over $10 trillion in assets, surpassing the combined wealth of numerous tech billionaires, Fink keeps a low profile compared to other financial giants.

Fink’s decisions, especially acquiring Barclays Global Investors, revolutionized asset management and solidified his legacy in finance.

Current Net Worth of Larry Fink – $1.1 Billion to $1.3 Billion

Larry Fink’s current net worth stands at approximately $1.1 billion to $1.3 billion as of 2025.

This wealth stems primarily from his position as CEO of BlackRock, the world’s largest asset management firm.

Despite overseeing a staggering $10+ trillion in assets, Fink’s fortune remains relatively modest compared to other financial industry leaders.

His annual compensation package typically ranges between $26 million and $36 million and consists of base salary, stock awards, and performance-based incentives.

Fink’s equity stake in BlackRock (between 0.27% and 0.7%) contributes significantly to his billionaire status, alongside dividend payments from his shareholdings.

While his wealth represents just 0.01% of BlackRock’s managed assets, Fink’s strategic business decisions have cemented his position among America’s billionaires.

Net Worth Evolution Over Time

This steady wealth progression mirrors BlackRock’s impressive growth trajectory under Fink’s leadership.

| YEAR | NET WORTH (USD) | KEY EVENTS & DEVELOPMENTS |

|---|---|---|

| 2018 | $1.0 billion | First achieved billionaire status as BlackRock continued expanding its global influence in asset management |

| 2022 | $1.27 billion | BlackRock’s assets under management surpassed the historic $10 trillion milestone, boosting Fink’s wealth |

| 2024 | $1.2 billion | Minor fluctuation in net worth due to stock market volatility affecting BlackRock share prices |

| 2025 | $1.3 billion | Recovery and growth through strategic investments in private markets, strengthening BlackRock’s portfolio diversity |

Fink’s fortune has shown stable, gradual growth over time, reflecting the sustainable business model at BlackRock.

Larry Fink’s Diversified Investments

Larry Fink, while primarily known for his BlackRock leadership, maintains a diversified investment portfolio beyond his company holdings.

As the steward of the world’s largest asset manager, Fink practices what he preaches regarding long-term, diversified investment strategies.

His personal portfolio likely mirrors BlackRock’s balanced approach across equities, bonds, alternative investments, and real estate.

Fink’s strategic vision for private market investments has expanded BlackRock’s reach and presumably enhanced his personal wealth allocation strategy.

Fun Fact: Despite managing more combined wealth than Elon Musk and Jeff Bezos put together, Fink’s personal net worth represents just 0.01% of BlackRock’s total assets under management.

Major Assets

Larry Fink’s most substantial asset is his BlackRock equity stake, valued between 0.27% and 0.7% of the company.

This ownership position represents the cornerstone of his wealth portfolio.

Beyond BlackRock shares, Fink likely maintains significant investments across various asset classes, including stocks, bonds, private equity, and alternative investments.

His investment approach presumably follows BlackRock’s diversification principles, though specific allocations remain private.

Properties

While the provided document provides limited information about Fink’s real estate holdings, as a billionaire financial executive, he likely owns multiple high-value properties.

Many Wall Street executives of his stature typically maintain residences in New York City and vacation properties in prestigious locations.

Property investments would align with Fink’s overall wealth preservation and growth strategy.

Overall Career Earnings

Throughout his illustrious career, Larry Fink has accumulated substantial wealth primarily through his BlackRock compensation packages.

In recent years, his annual earnings have consistently ranged between $26 million and $36 million, including salary, stock awards, and performance bonuses.

Since co-founding BlackRock in 1988, Fink has changed the firm into the world’s largest asset manager, indirectly boosting his personal fortune.

His strategic decisions, including the acquisition of Barclays Global Investors, have expanded BlackRock’s market dominance and enhanced his earnings.

Fink’s wealth accumulation represents decades of leadership in the financial industry rather than overnight success.

I’ll create these additional sections about Larry Fink’s life and activities based on the information provided.

Larry Fink’s Private Life

Larry Fink maintains a relatively low profile despite his influential position in global finance.

Unlike some Wall Street executives who embrace the public spotlight, Fink has focused primarily on building BlackRock rather than cultivating personal fame.

His management style reflects this measured approach, emphasizing long-term strategy over short-term gains.

Though a financial titan managing trillions, Fink preserves a separation between his professional responsibilities and personal affairs.

Early Life

While the provided document contains limited information about Fink’s early years, public records indicate he was born in 1952 in California.

His voyage to financial leadership began with academic foundations in political science and later finance.

Like many successful finance professionals, Fink’s early experiences shaped his risk management philosophy that would later define BlackRock’s approach to investment.

Career Beginnings

Before co-founding BlackRock in 1988, Fink built his expertise at First Boston (now Credit Suisse), where he developed his understanding of the mortgage securities market.

This early career experience proved formative, as Fink witnessed firsthand the consequences of inadequate risk management.

These lessons shaped his risk-focused investment methodology at BlackRock, which helped the firm navigate major financial crises and manage trillions.

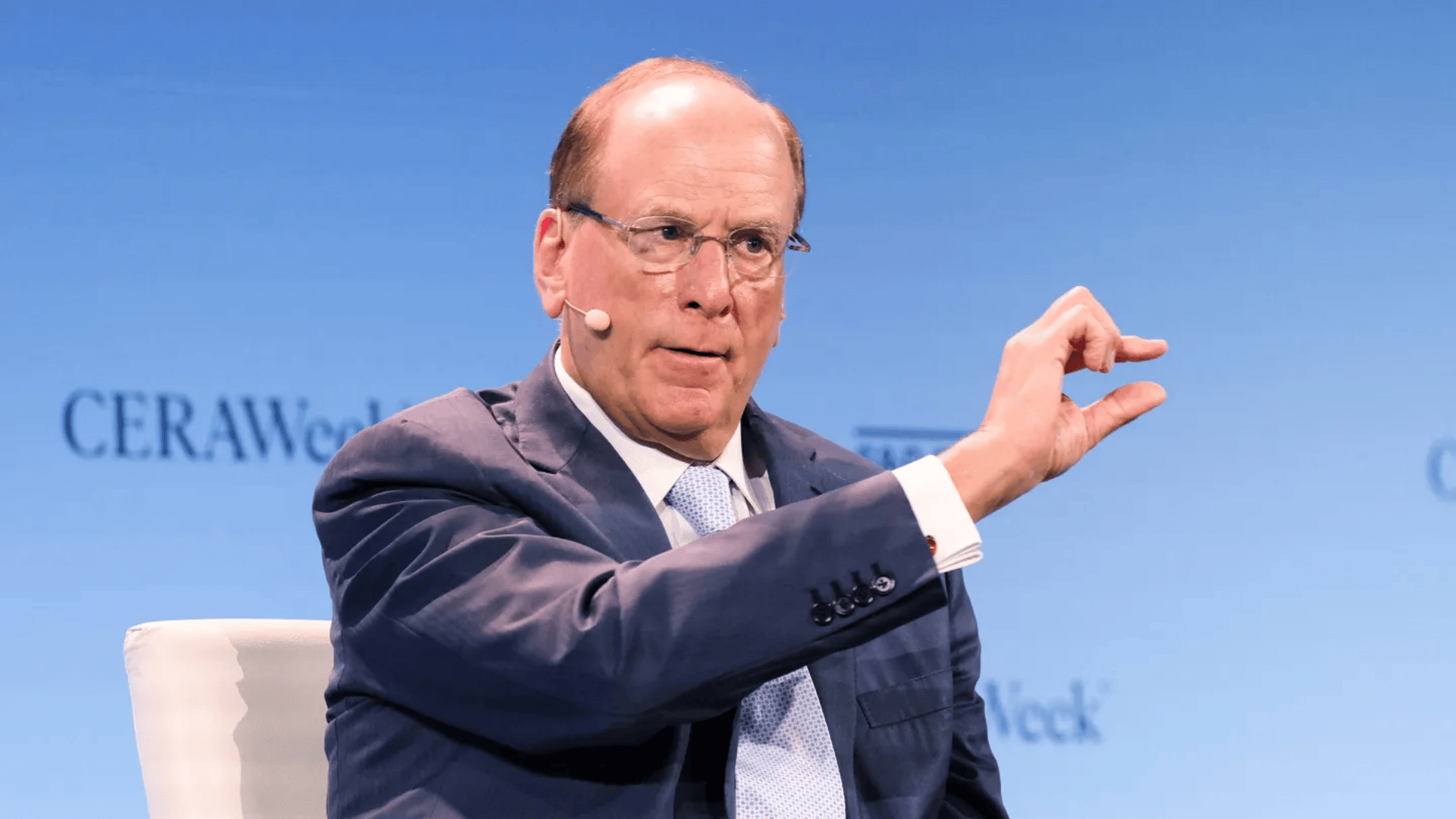

Larry Fink’s Future Investment Goals

Looking ahead, Fink appears focused on expanding BlackRock’s presence in private markets, an area highlighted in recent strategic initiatives.

This push reflects his vision for diversification beyond traditional public equities and fixed income.

Under Fink’s direction, BlackRock continues prioritizing sustainable and ESG investments, positioning the firm for evolving market demands.

Fink likely aims to strengthen BlackRock’s technological capabilities further, maintaining a competitive advantage through proprietary systems like Aladdin.

The document indicates that Fink’s 2025 net worth growth correlates with “strategic private-market investments,” suggesting this remains a personal priority as well.

His investment goals likely align with BlackRock’s broader strategy of balanced growth across diverse asset classes while adapting to emerging global financial trends.

Philanthropy and Charity Work

While the provided document doesn’t detail Fink’s philanthropic activities, as a billionaire financial leader, he likely engages in significant charitable giving.

Many executives of his stature establish foundations or support causes aligned with their values and experiences.

With BlackRock’s growing focus on sustainability, Fink may direct philanthropy toward environmental causes or financial education.

BlackRock itself has launched various social impact programs, which likely reflect Fink’s personal values to some degree.

As CEO, his influence shapes the company’s corporate social responsibility approach.

Without specific details, we can only state that philanthropic engagement aligns with practices typical of financial leaders of Fink’s prominence and wealth.

However, his specific charitable focuses and donation amounts aren’t specified in the provided information.

Conclusion

From mortgage securities specialist to architect of the world’s largest asset manager, Larry Fink’s career exemplifies disciplined growth and strategic foresight.

His wealth, while substantial, represents just a fraction of the massive portfolio he oversees at BlackRock.

Fink’s investment approach, diversified, measured, and forward-looking, mirrors the principles that guided BlackRock’s expansion.

As he continues pushing into private markets and sustainable investments, Fink remains committed to adapting to evolving financial landscapes.

Though private about his personal life and philanthropic endeavors, his influence extends far beyond his net worth.

Larry Fink’s legacy lies not in the billions he’s accumulated but in changing how the world approaches institutional investing and risk management.